Wondering how to save money to travel the world?

When Jeremy and I were getting ready to trade in our address and 9-to-5 jobs for a nomadic life and a lot of question marks, we pulled out just about every trick we could find to save our hard-earned cash and use it for a fantastic collection of life-changing experiences abroad.

To be honest, we got a bit ridiculous about it.

But you know what?

We don’t regret a single penny-pinching move that we made, and we didn’t mind it much at the time, either.

It’s absolutely amazing how little restaurant meals and small creature comforts matter when chasing a passion–and we were on fire with passion during the months leading up to starting our round-the-world trip (and luckily for us, every day since).

At the time we started saving for travel, we were both working standard office jobs in San Antonio, where we owned a home and had a fairly typical US suburban lifestyle.

It has been a decade (!) since we started to feverishly save money to travel… and thanks to both the sizable savings account we built and some hard and creative work, we managed to craft a life of travel that meant we never had to go back to those 9-to-5 jobs again.

Table of Contents

How to Use These Tips to Save Money Fast

Every time I read a “how to save money to travel” guide in those days, I looked for any new ideas that we could use, knowing that most of them wouldn’t apply to us. After all, finances are often far too individual for sweeping proclamations.

If I had read one more post suggesting to cut down on cab fares to save money for travel in those days, my eyes would have rolled into the back of my head. Some of us don’t come from places with oodles of cabs or any useful public transportation options in the first place!

That doesn’t make the author’s advice useless–just useless to us. Usually, though, we’re able to pull out 1-2 ideas from each author and make them our own. That’s my goal for this list, as well.

This isn’t a start-to-finish how-to guide for anyone, it’s simply our experience of saving money to travel the world.

Take what sounds interesting, and leave the rest.

From a couple of nickels to thousands of dollars, here is everything that we did, big and small, to save up roughly $40,000 to travel the world.

How to Save Money to Travel: Tips + Tricks

Cut the subscription services.

When I originally published this blog post, this line said to eliminate cable, not subscriptions… but while I still recommend cutting cable on the off-chance you have it, subscription services in general are more relevant today.

Keep one streaming service, at maximum. If you can go cold turkey, even better.

Look into Kanopy and Hoopla through your library if you have access to them!

And think beyond TV subscriptions: Spotify, Prime, subscribe-and-save products that you don’t actually need, software subscriptions, and more all fall into this category.

Manage the temperature.

In sweltering San Antonio, we kept our house at roughly 78°F during the day in the summer, 75°F at night.

In the winter? Roughly 68°F and 65°F.

As a plus, this was also much more environmentally friendly than running the AC and heat more often… and good practice for when we were traveling the world, because even when air con and heat are available abroad, they’re not generally kept at “American” standards.

(2026 Note: I’m chuckling a bit as I update this, because we actually keep our house even colder in the winter now. I guess we got used to even more mild temperature control over the years!)

Keep transport expenses as low as possible.

Despite our post-grad jobs, Jeremy drove a 2006 Suzuki Forenza leftover from college when we were saving for travel.

Our main car was a 2015 Honda Fit at this point, purchased out of necessity when my beloved 2005 Honda Accord was totaled in an accident.

We carpooled to work during much of the year leading up to traveling (as I mentioned, public transportation was not an option), which offered significant savings as well.

Outside of work, driving also became strategic overall: we made an effort to limit how many miles we drove on a daily basis and planned outings accordingly.

Eventually, both cars got sold to fund our travel budget. The Suzuki was sold before we left, and our Honda Fit was jettisoned 6 months later to fund our overland backpacking trip from Mexico City to Bocas del Toro, Panama.

Keep a careful budget.

This isn’t something that started with our goal of saving money fast to travel, but it definitely paid off!

We have always tracked every penny we’ve ever spent, and 10 years after originally publishing this blog post, I suspect we always will.

Personally, I’ve always used very basic means to do this (originally a notebook, now a spreadsheet), but tools like YNAB are very popular if you need something more detailed!

Keep discretionary expenses low.

Everything that wasn’t a strict necessity–so restaurant meals, random activities, going out with friends, etc–was subject to immense scrutiny while we were saving for travel.

I won’t say we never spent money, of course, but we spent much, much less than we did before.

In the age of delivery apps and one-click online shopping, it’s easier than ever to spend money without thinking it through.

I recommend deleting every last shopping app from your phone and swearing off delivery while saving to travel (and then marveling at how much more affordable it is abroad, if you choose to use it on the road).

Reconsider gifts.

To this day, Jeremy and I don’t exchange physical gifts with each other.

At some point when we were engaged, we stopped swapping gifts for birthdays, Christmases, and anniversaries.

We found that we were always happy to put the money toward a travel experience or local adventure together instead.

These days, a nice meal out or a fun activity (hiking, whitewater rafting, climbing a monument, etc.) in whatever country we happen to be in is our preferred way to celebrate milestones together.

Take advantage of credit cards.

We used travel rewards credit cards to maximize our rewards and limit how much cash (ie, invisible, untracked money) we used.

Obviously this is only a good idea if you’re able to carefully manage your money and never pay a penny of interest, but if that’s something you can do, using the right credit card can be like getting a discount on every purchase you make.

Shopping portals through banks and credit cards can have great deals as well, and we almost always check them before making a non-routine purchase these days.

Pay yourself first.

The first bills that got paid were always our savings accounts, including the travel account.

Payday was my favorite day when saving to travel because it was the day I watched our travel dreams get closer in time!

Top off your travel fund with excess funds.

At the end of the month, any leftover money from our budget was swept into the travel account rather than left in our checking account to tempt us.

Even if it was only a few dollars, we still moved it over in order to watch our travel savings grow penny by penny.

This was also very motivating when it came to resisting unnecessary expenses: we knew that anything we didn’t spend was like a travel bonus!

Clean out your freezer.

We ran an experiment in our house to see how long we could go without grocery shopping turning our most frugal living days.

We made it almost 3 weeks, revealing just how many packages of meat and vegetables had ended up in our freezer.

This also benefited us by making sure we didn’t leave any food waste behind when moving!

… and cook in general.

If you don’t know how to cook from scratch, now is the time to learn!

It’s cheap, it’s creative, it’s empowering, and it is absurdly affordable compared to eating out or cooking from prepared/branded ingredients.

You don’t need to become a chef overnight, but cooking from scratch (even something as simple as pancakes or pasta sauce) is an excellent way to save money and to improve your life skills.

You may find that it comes in handy when traveling, too! When familiar brands and boxed goods are harder to come by (or many times more expensive than a local option), knowing the basic building blocks of good food gives you the power to cook well anywhere.

Use a meal plan.

As our planned departure date got closer in time, we started getting more and more strict with a meal plan.

We were careful to buy only the food we needed and to take advantage of all leftovers when saving money to travel.

This ended up being a great life lesson as well, and we’ve generated far less food waste ever since!

Cut the dryer.

We stopped using the electric dryer for most of our laundry and started hanging our clothes to dry.

Not only is this better for both the environment and your clothes, but it also ended up being excellent practice at traveling long term for us: most places don’t use electric dryers as we do in the USA!

(2026 Update: Even though we’re no longer in travel-saving mode and we live in the US again, we still barely use our dryer. We simply got used to hanging our clothes to dry when living in Lisbon and traveling the world, and it’s incredible how much longer our clothes last this way!)

Buy nothing.

Clothes, gadgets, household items, makeup: there were a lot of things that we stopped buy when saving money to travel the world that once upon a time we would have considered necessities!

It was honestly a very freeing experience, and it also helped us adopt a more minimalist mindset before we started living out of backpacks for what would turn out to be years.

We haven’t fully shaken that mindset since, and we consider that a good thing!

… and when you have to buy something, wait.

If there was something we truly felt like we needed (we did have some travel gadgets to buy before leaving, after all), we were careful not to be spontaneous: price comparisons and sleeping on a purchase decision were common.

Negotiate monthly bills.

We negotiated a better price on both our internet and phones by threatening to move companies (it wasn’t an empty threat).

Work as much as you can.

This is an obvious solution to saving money for a trip, of course, but overtime was a regular occurrence during this time in our lives.

Cut down on personal grooming expenses.

My makeup routine got an overhaul during this time–as in, I stopped wearing it most of the time.

Turns out that this was a great habit to pick up before traveling to incredibly humid climates!

We also both stretched out our haircuts and got them done inexpensively.

These days, we love getting our haircuts at independent salons abroad whenever we can–I got the best haircut of my life in Istanbul).

(2026 Update: I now cut my own hair more often than not, so this habit has continued.)

Cut out online temptation.

If you don’t see the adorable workout clothes or fun travel gadgets on social media, you can’t want them.

You can try to train your algorithm, but of course, the best way to avoid these temptations is to spend less time on your phone altogether.

Compare every expense to travel experiences.

One of our most effective tips for how to save money to travel is simple: think about nothing else (which, if you’re saving for a long-term trip, you can probably relate).

Literally every purchase was compared to travel during our time spent intensely saving.

A lunch out with coworkers? That’s a whole day’s food in Thailand!

A new piece of clothing? Never mind, I’d rather go kayaking in Croatia!

Sell off excess items.

We started categorizing our belongings and experimenting with Craigslist (today, that would also include Facebook Marketplace) to offload anything and everything we wouldn’t take with us to travel, including everything from electronic gadgets to my old flute to Jeremy’s car to my wedding dress.

What we couldn’t sell and weren’t set on keeping was donated in an effort to cut down on moving costs.

Leave expensive assets behind.

We listed our house on the market and made an effort to have it flawlessly clean and ready for showings 24/7.

If you don’t plan to sell your home, figuring out a rental situation can be a great way to save money while traveling, as you can turn your home into monthly travel funds.

Renters, look into the details of subletting or ending your lease early, if applicable.

Have a garage sale.

We hosted an enormous garage sale a few months before leaving to travel the world.

Furniture, books, kitchen gadgets, picture frames, wedding presents.

A little advertising and several hours later, we were $400 richer (or, based on our initial budget of $76/day, 5.25 days of travel richer).

Sell off furniture.

We sold about half of our furniture with our house, and most of the other half through Craigslist and our garage sale.

This can not only boost your savings account but also cut down on moving and/or storage costs while you’re off traveling the world.

Skip the movers, if possible.

We hired a truck and drove our remaining belongings to dad’s house, who was kind enough to store them, rather than use movers.

We also packed 90% of the house ourselves.

Look into storage policies for vehicles.

Right before departure, we put our Honda Fit into a “storage policy” (my mom was nice enough to store it), meaning that we paid pennies on the dollar to insure our car in exchange for the promise that we wouldn’t drive it.

Get creative with date night.

As the date of our one-way flight to Madrid drew closer, our “dates” became exercises in entertaining ourselves without spending money.

We took long walks around the neighborhood or nearby parks, did research/planned for the trip (which became an enormously engrossing hobby!), experimented with different recipes, and practiced taking photos with our new camera.

Cut living expenses early.

For the 2.5 months between our house closing and the beginning of our travels, we stayed with my mom–a huge privilege and a lucky break.

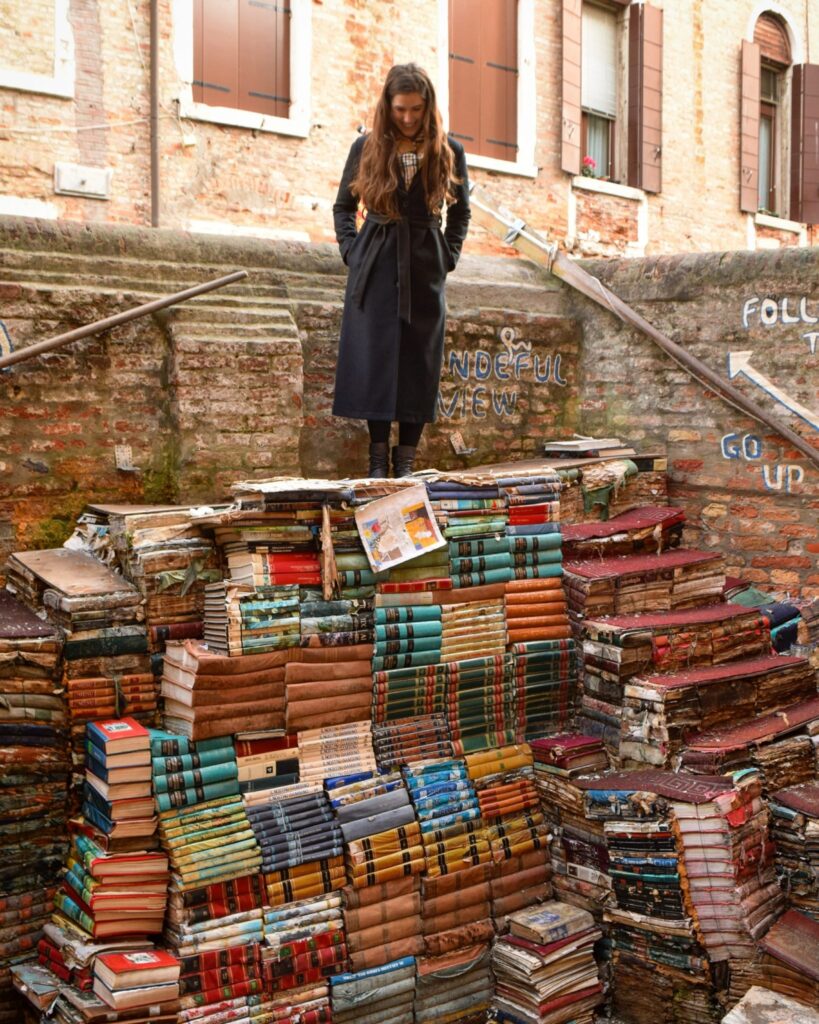

Fall in love with the library.

The library became our best friend while saving money to travel, and still is to this day!

Other Ways to Save Money for a Trip

It has been more than 10 years since we were at the height of our initial money-saving focus, though many of these frugal habits have stuck with us for life!

Since then, we’ve sustained our lifestyle in several ways, including remote work, freelancing, and most importantly, this travel blog.

If we could go back in time to tell our past selves how to save for travel, this is what we’d add.

Start side hustles early.

While we ended up being able to transform our RTW trip into a nomadic lifestyle, it would have been much easier to do if we started considering location-independent ways to make money before we left, rather than months into our trip.

Don’t buy too many gadgets.

Spend less time and money putting together the perfect packing list before leaving for a backpacking trip than you think.

Nine times out of ten, it’s better to keep more cash on hand and buy things abroad as you need them.

Don’t plan too far ahead.

We ended up losing a bit of money early in our trip when we veered off our planned course within a month of starting to travel the world.

It’s hard to know what you’ll want to do once your trip begins, so don’t plan further in advance than you have to!

Get rid of more than you think you should.

When we sold our house and got rid of most of our belongings, we absolutely did not get rid of enough.

Objectively, we didn’t keep a ton, but going through the boxes years later, it’s laughable what we thought we needed.

If you’re planning an open-ended trip, especially if you’re paying for storage, keep only what is nostalgic or entirely practical.

What Happened After We Saved Money to Travel the World

The savings, of course, is not the end of the story.

Armed with our carefully calculated travel budget and determination to stay on the road for as long as possible, we continued tracking our money very carefully while traveling.

Our initial funds ended up lasting us a bit longer than we expected, thanks to my cautious nature causing me to pad them with plenty of room for emergencies and changing plans.

After our first several months, we ended up selling our second car–a Honda Fit–to finance about 6 more months of backpacking through Mexico and Central America.

That took us to about the one-year anniversary of our full-time travels, which is when we started fully financing our continued lifestyle through online work.

At first that mostly meant Jeremy’s work as a software developer, but over the years this travel blog became a larger and larger portion of our income until eventually, running Our Escape Clause (and now also Lone Star Travel Guide) became our sole source of income as a couple.

Ultimately, it was a huge combination of factors that allowed us to save enough money to travel long-term. Our income helped (two employed college graduates with no kids and no debt outside of a mortgage–we weren’t hurting for money), our lack of student loans helped, and our sheer determination helped.

Even getting married young and the fact that we’ve thought of money as a team since our very early twenties helped, though that’s not exactly something that is able to be or should be replicated on a whim.

While there were a million and one ways that we could have spent our hard-earned savings, I feel very confident in saying that there is absolutely nothing else that we would have rather put the money toward.

Every penny we saved for traveling the world was money incredibly well-spent, and it permanently changed our lives for the better.

Read More About Traveling the World

Are you planning a long-term backpacking trip like we were when saving money to travel the world?

If so, you might also like these blog posts:

- 13 Minimalist Traveling Tips for Living Out of a Backpack

- Thailand Travel Budget: Exactly What Our Thailand Vacation Cost

- 9 Ways Long Term Travel is Cheaper Than You Think

- How Much Does a Trip to Paris Cost? (Essential Budget Tips!)

- 25 Long Haul Flight Essentials + Long Flight Tips

Good information was shared, thanks for this.

There were so many helpful tips & how to save money travel tips if they have gone under so I’m saving this for reference so a grateful thank you to everyone

Bravo!! I so admire your guts and determination! Your stage of life is the perfect time to do this. My wife and I are fortunate to travel more that most Americans – generally 5 weeks a year, but I am always dreaming of reaching a point where we can travel several months a year. That lifestyle might having to wait until we finish raising the kids. There are some families reveling full time, but my wife doesn’t want a nomadic life.

I am a computer engineer myself, and often dream of the freedom of a freelance lifestyle, but it seems tough to pull off for our work – which tends to be large team projects. So I am very curious about the type and source of freelance work that Jeremy has been able to find remotely. Mind sharing some details and tips?

Thanks so much, Steve! We’re definitely still having an amazing time 3+ years later (though it probably will be time for an apartment soon!).

Jeremy’s freelance work has gone through several stages, including a brief time working for a large US corporation as a remote developer, but what he prefers to do these days is work with one major client at a time. He’s been working on the same project since January, which is lovely. It is a team project, which is typical, but video calls and phone calls can accomplish a lot!

He’s part of a couple of organizations to help put him in touch with clients, but they come through contacts these days too.

What do you to do about health insurance?

Hi Donna!

We’ve had a few different health insurance setups over the last 2+ years, but right now we keep a travel insurance policy through World Nomads that covers us for accidents/emergencies/acute medical care while traveling. Luckily, we haven’t had any big emergencies to speak of! The times we have been sick the cost has bee far too low to bother with a claim–for example, when I got an eye infection in Hungary, two appointments with an English-speaking doctor in Budapest and two sets of eye drops came to under $20 USD total.

For routine health care like my well-woman exam, dental cleanings, eye exams, etc, we simply pay out of pocket along the way (and generally spend less in one year than what one month’s premium on a US health plan would be!).

Would you mind if we feature you on our blog.

Feel free to send us an email at kate@ourescapeclause.com, we’d love to chat about what you have in mind!

I love this! It’s so refreshing to see someone accept the fact that you’re human and some days you just want someone else to make your damn latte.

So true, Sandy! I’ve noticed hat seems to happen even more in places with excellent coffee and a nice cafe culture… very mysterious. 😉

This is a great post. I’m trying to save up again for a trip again and will definitely use some of these tips.

High praise, Jen! 🙂 Good luck on your next trip!

Thanks, Bethany!

It’s such a fun season to look back on, right?! I’d never want to go back, since that was pre-travel days, but the constant excitement and anticipation was a memorable experience in its own right!

We actually have Netflix back now, at Jeremy’s insistence, though the days of NO monthly expenses were lots of fun. The new ability to download movies and shows to watch offline has been a game changer for his bus trips, though!

I love this list! It reminds me so much of the season when we were in the earn/save mode for our big trip. I remember the joy of payday when we were at the point of funneling a huge chunk of earnings each month to the travel account. It was surreal to see the balance finally crest $40K, and for the rest of my life I’ll be so proud of that discipline and accomplishment.

I like the way you shared your list in phases, too. It makes a lot of sense to have the efforts ramp up, like your discretionary category amount moving from $350 to $200 and eventually canceling Netflix 😉 I remember when my husband finally gave up craft beer at the end and switched to Pabst Blue Ribbon just to push is in the final stretch. It’s the little things, you know? 🙂